The Global Superyacht Market Finds Its Footing

Why 2025 Marked a True Return to Health for 24m+ Yacht Sales

By any reasonable measure, the global superyacht market entered 2023 in a state of recalibration. The extraordinary surge in transactions during the COVID years was already well understood as an anomaly—driven by forced liquidity, lifestyle re-prioritization, and timing distortions rather than organic demand. What followed was not a collapse, but a necessary normalization.

From January 2023 forward, the market began the slower, more telling work of re-establishing its natural rhythm.

2023–2024: Normalization, Not Weakness

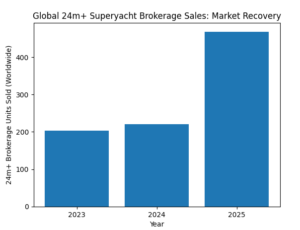

In 2023, global brokerage activity for yachts 24 meters and above totaled approximately 203 completed transactions worldwide. That year represented the true post-COVID baseline—less frenetic than 2021–2022, but still historically solid by pre-pandemic standards. Buyers were selective, sellers were adjusting expectations, and deal velocity slowed as price discovery reasserted itself.

The trend continued through 2024. Transaction volumes remained in the low-200-unit range, modestly above 2023 but still well below the pandemic peak. Importantly, this was not a market losing relevance—it was one regaining discipline. Inventory levels stabilized, financing normalized, and buyers re-entered with clearer intent rather than urgency.

2025: Volume Returns—Decisively

What changed in 2025 was not sentiment alone, but participation.

According to BOATPro data, 468 yachts measuring 24 meters and above sold worldwide on the brokerage market in 2025. That figure alone tells the story. Transaction volume more than doubled compared to 2023, marking the strongest full year of the current market cycle for large-yacht brokerage.

Equally important, this growth was not concentrated in a single quarter or distorted by one region. Activity built steadily throughout the year, with multiple periods confirming that momentum had returned:

– Q1 2025 closed with 125 brokerage sales, representing the strongest first quarter in three years and signaling early that buyer confidence had shifted.

– Q3 2025 delivered 86 completed sales and approximately $1.9 billion in value, making it the strongest quarter of the year by gross dollar volume.

– December 2025 alone recorded 52 brokerage transactions, up from just 36 in December 2024—an increase of roughly 66% year over year in unit count.

Using conservative currency conversions and rounded estimates, total global brokerage value for 24m+ yachts in 2025 approached $5 billion, compared with roughly $3 billion in both 2023 and 2024.

What This Actually Means

The significance of 2025 is not about incremental pricing gains or headline-grabbing individual sales. It is about market depth.

For the first time since the pandemic distortion worked its way through the system, the superyacht brokerage market demonstrated that it could sustain higher transaction volumes without artificial stimulus. Buyers returned in meaningful numbers. Sellers met the market. Deals closed.

This is what a healthy market looks like.

.

The Bigger Picture

When viewed across the full arc from January 2023 to today, the takeaway is clear:

– 2023 reset expectations

– 2024 stabilized participation

– 2025 restored volume

COVID may have accelerated interest in yachting, but 2025 confirmed that demand at the 24-meter-plus level is not temporary. It is durable, global, and once again operating on fundamentals rather than urgency.

For owners, buyers, and brokers alike, that matters far more than any single record sale ever could.

AM

About the Author

Andy Miles has spent over three decades immersed in the global yachting industry and nearly 20 years tracking and analyzing the crewed yacht sales market, with a particular focus on brokerage and new-build activity above 24 meters. As principal of Miles Yacht Group, he has advised buyers and sellers through multiple market cycles and maintains long-term, data-driven oversight of global sales activity using proprietary tracking and established market analytics sources.

Andy Miles is regularly published across print and digital platforms, with market commentary appearing in industry publications and distributed through media and social channels with an estimated reach exceeding 100,000 readers, providing ongoing analysis of trends, transaction volume, and buyer behavior at the top end of the superyacht market.