Bonus Depreciation of Vessels in 2025

Reflecting the “Big Beautiful Bill” Tax Reform

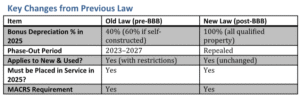

Overview of Tax Law Change

Under the “Big Beautiful Bill” signed into law in July 2025, the bonus depreciation rules

under IRC §168(k) have been reinstated to 100% for qualified property placed in service

after January 1, 2025, and before January 1, 2028. This represents a reversal of the prior

phase-out schedule.

Revised Questions Presented

• What must the Owner do to qualify for 100% bonus depreciation under the new law?

• What planning steps are now especially important to avoid recapture of the 100% bonus

depreciation after 2025?

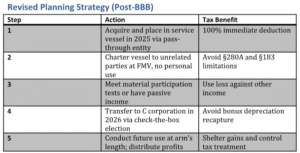

Updated Summary of Recommended Actions

To maximize tax benefits and remain compliant, the Owner should:

1. Place the vessel in service in 2025 and ensure it is available for third-party charter.

2. Acquire and operate the vessel through a pass-through entity to use the 2025

depreciation loss to offset other income.

3. Document the vessel under U.S. Coast Guard or ensure that it is used predominantly in

the U.S. or a U.S. possession.

4. Avoid any personal use of the vessel during 2025 to circumvent §280A “vacation home”

restrictions.

5. Ensure crew is employed by the vessel-owning entity or its disregarded entity.

6. Implement a formal, multi-year business plan that shows a projected profit.

7. Actively promote and charter the vessel to unrelated parties at market rates.

8. Track and establish material participation or have passive income to offset the loss.

9. Transfer the vessel to a domestic C corporation in 2026 to avoid recapture under

§280F(b)(2).

10. Maintain strict arm’s-length dealings between the Owner and the C corporation post-

transfer.

Implications of the Law Change

✅ Full Expensing Opportunity

Owners can now expense 100% of the cost of qualifying vessels acquired and placed into

charter service in 2025.

⚠️ Recapture Still Applies

If in any subsequent year the Owner’s qualified business use falls to 50% or less, recapture

rules under §280F(b)(2) may apply unless the vessel is contributed to a domestic C

corporation.

Conclusion

The reinstatement of 100% bonus depreciation under the Big Beautiful Bill creates a critical

window of opportunity for yacht owners and charter operators in 2025. Proper

planning—from purchase structure to operations and corporate transfer—can allow

taxpayers to fully expense the cost of a vessel while avoiding recapture.